Global State of Beauty

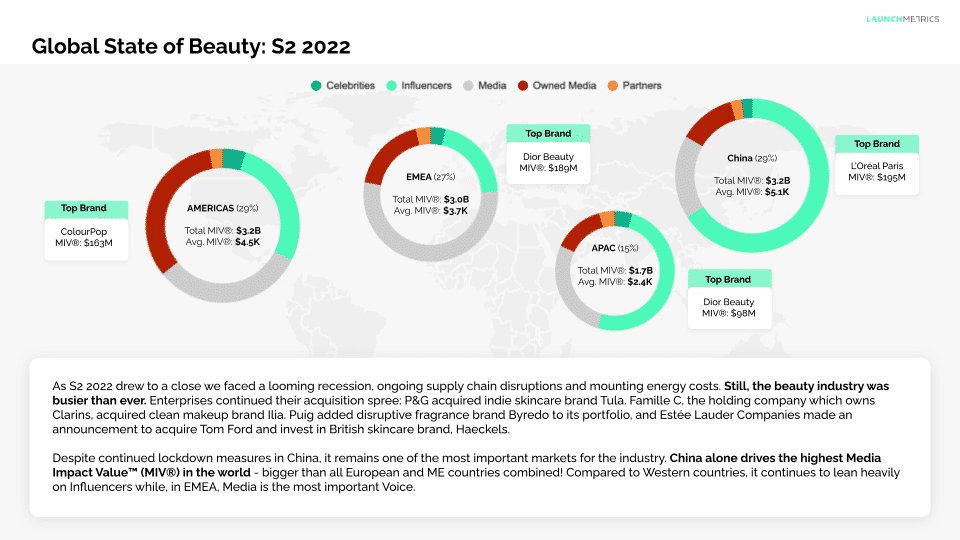

Despite a looming recession, ongoing supply chain disruptions, and mounting energy costs, the state of the beauty industry is stronger than ever. The series of acquisitions in the past year indicates that global beauty conglomerates, such as P&G, Puig, or Estee Lauder are aiming to diversify their portfolios and gain access to niche audiences. Again, China, despite continuous lockdowns and covid-safety measures, remains a key market for the industry by driving the highest MIV® worldwide - higher than the MIV® of Europe and the Middle East combined.

‘Beauty Insights by Launchmetrics’ report provides an overview of the state of beauty in the second semester of 2022. We uncover trends in the media landscape across the globe and compile a ranking of top brands and enterprises according to their Media Impact Value™. Here are the key takeaways from our recent report.

Shift in share of voice in EMEA and APAC regions

Globally, we are seeing that year after year, owned media channels are experiencing significant growth. In S2 of 2022, MIV® generated via owned media increased by 23%, compared to the previous year. By leveraging owned media profiles, brands get to control their content, ensuring it’s consistent with brand values. They also provide means to directly interact with their audience and foster a meaningful connection.

During this shift, while celebrity voices are still vital in the beauty space worldwide, year-on-year their significance is declining. In S2 of 2022, MIV® generated by celebrity voices has experienced a 24% decrease. Nonetheless, celebrity voices continue to be amplified by other channels. Owned media and media can still find great success through partnerships and endorsements with celebrities.

Besides, it deems important that brands who operate globally aim to have a nuanced, tailored strategy that aligns with the culture and trends in each region. The heritage of media as opinion leaders preserves in Europe, making it a fundamental voice for the region in the beauty industry. In the APAC region, however, the industry relies heavily on the voice of key opinion leaders (KOLs), who continue to drive MIV® due to strong ties with their audience.

Micro-Influencers resonate with their loyal and engaged communities

In 2023, influencers are still one of the most important drivers of MIV® when it comes to beauty. However, not all influencers are created equal. In particular, micro-influencers have seen the most significant year-on-year growth in MIV®, despite accounting for just 7.7% of the total MIV® garnered by all tier influencers. Micro-influencers are leading growth and resonance by capitalizing on their engaged community that often caters to a certain niche. Their success can be partially attributed to the rise of TikTok, where audiences are increasingly drawn to everyday, authentic content, created by micro-influencers who seem more “relatable”.

Still, star influencers perform best in terms of Media Impact Value™, driving 45% of total MIV® in S2 in 2022 with a $21K average MIV® per placement, despite their share of value decreasing YoY. It is mainly because they are less interactive across platforms compared to lower tier influencers, who are becoming more active and over-indexing on average engagement rate.

TikTok continues to grow, thanks to “smaller” influencers

Even though Instagram maintains its spot as a leading social network in the beauty industry, TikTok leads in growth by 127% increase in MIV® year after year. The popularity of TikTok is largely related to its younger, Gen Z audience and their preference for more organic, and unpolished content. Because of that, mid-tier and mega influencers have a stronger presence on the app, compared to Instagram, where star influencers play a bigger role with curated feeds and professional content.

Instagram has been taking actions to compete with TikTok, most notably with the launch of IG Reels. Both Reels and TikTok have similar features, however, TikTok has a younger demographic and a more algorithm-driven content discovery process, tailored to the user’s preferences. Thus, when tailoring their social media strategy, brands should consider via which influencers, and through which channels they can succeed to reach their target audience.

Publishers and media shift away from print to online

Lastly, in the ever-changing media landscape, publishers are seeing better engagement online, compared to print media. MIV® figures assigned to online media have increased by 39% while Print has seen a decline of 28% year-on-year. Online coverage allows media sources to reach wider readership as the culture and consumption shift to the internet.

The Beauty Insights Report not only elaborates on the state of the beauty today, but also features rankings of top performing brands in the industry, as well as case studies. You will see what are the top 10 beauty brands, by MIV®, the top 10 by growth in MIV® and which enterprises are among 10 top drivers of Media Impact Value™.

Discover our latest report and find out which beauty brands made it to the 700 performers ranking based on MIV® in the second semester of 2022 here.